All to know about Tax Filing

How does the Tax Filing Process work?

1. Receiving your form(s) W-2:

- Your W-2 Form summarizes your earnings and taxes withheld from you the previous year. Your employer will mail your W-2 Form to you by January 31, 2025. If you do not receive it by February 15, 2025, contact your employer to find out where it was sent or to request a copy.

- If you had more than one employer, you will have more than one form W-2.

- You will need to WAIT to file until you have ALL of your W-2 forms from ALL employers that withheld taxes. If you do not wait, you may miss out on part of your refund and will need to file an amended return later which can be time consuming and costly!

*Note: We take pride in offering a service at TaxPrime that assists users in locating missing W-2 forms for both prior and current tax years. This feature underscores our commitment to providing a comprehensive solution for accurate and efficient tax filings. Click here for more info.

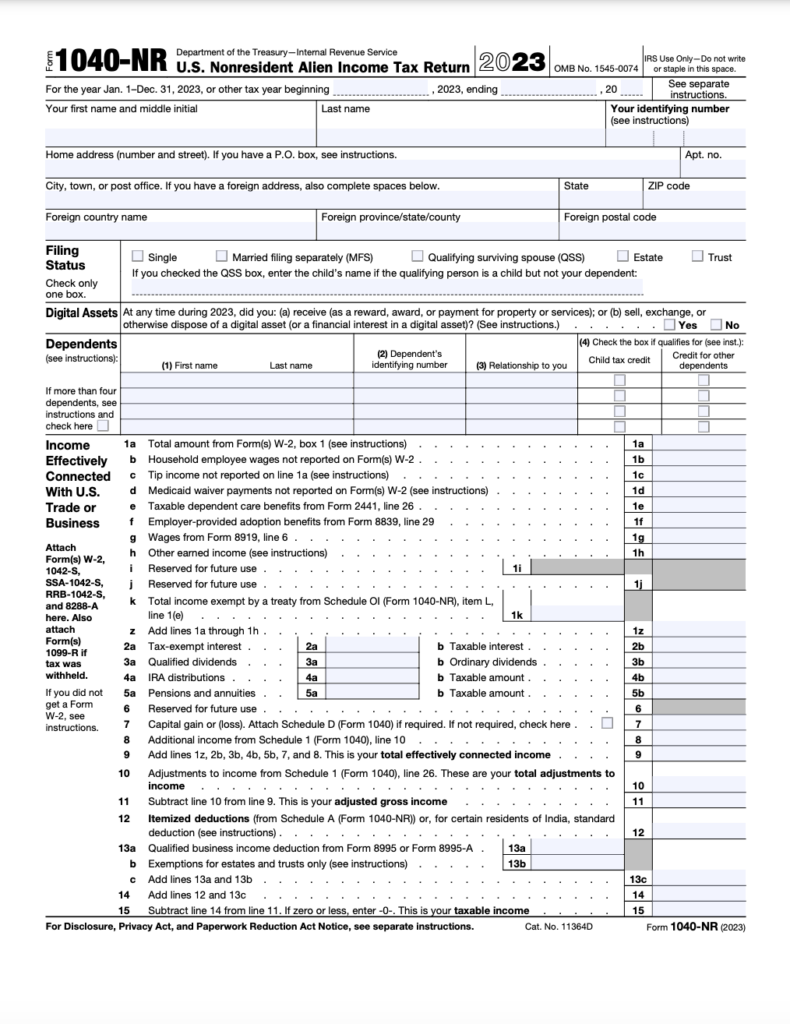

2. Filing your Federal Tax Return

After you receive your W-2, you will file a 1040-NR (Non-Resident Alien) tax form along with the supporting forms (Schedule A, Schedule OI, and any other form that may apply to your tax situation).

*The deadline to file your taxes is April 15. The sooner you complete your taxes, the sooner you receive your tax refund, if eligible!

3. Filing your State Tax return:

- Filing a Federal Tax Return should automatically trigger your state filing with the State (or States) on your form W-2(s).

- A good Tax prep service will also be able to file your state return at little to no extra cost to you!

*NOTE – Not every state requires that you pay income tax! These states will not require a tax return and you will receive no state tax refund because you did not have to pay it in the first place!

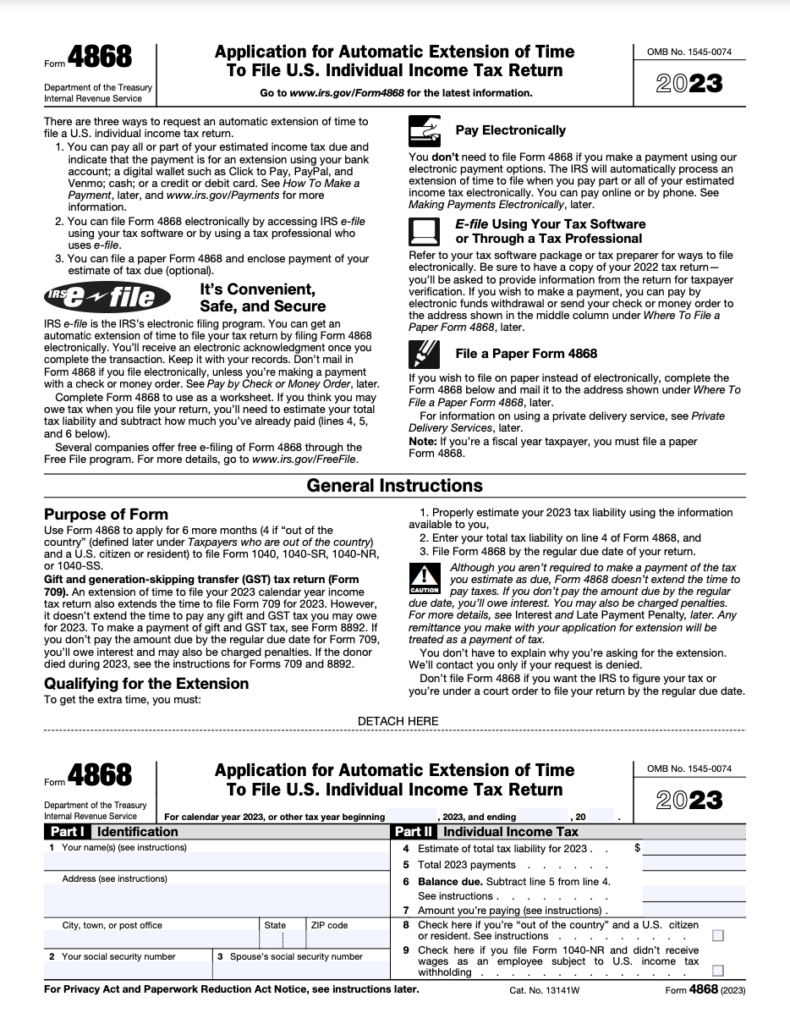

4. Filing extensions:

- If you are unable to complete your tax return by the deadline or do not receive your W-2 before April 15, it’s important to file an extension with the IRS.

- This step is crucial to avoid potential late-filing penalties and ensures that you retain the ability to receive your return. Filing an extension grants you additional time, moving your deadline to October 15.

Requesting an Extension of Time to File:

If you are unable to submit your tax form(s) by the tax deadline, use Form 4868 to apply for an extension of time to file Form 1040 or 1040NR. If you use this form, your deadline to file your tax return will be October 15.

To get the extra time you must:

- Estimate the amount you owe.

- Enter that amount on Line 4 of Form 4868, and include your payment with the form. ( $0 for the J-1)

- Mail Form 4868 in time no later than April 15.

Depending on the state(s) where you worked or lived, you may also need to file state tax extension forms. Each state has different requirements. Be sure to search the state tax agency in both states, if you lived in one and worked in another.

Or

E-file your Extension (form 4868) with us.

5. Receiving your refund(s):

- Depending on your tax return, you may be due a refund from the Federal Government and/or the State(s) you paid income taxes in.

- Refunds may be collected several ways; via a paper check mailed to you at your address in your home country OR via direct deposit if you have a U.S. bank account and routing number. (This applies to WISE accounts and prepaid US debit cards!)

- A paper check may take several months to arrive however Direct Deposit can arrive in as little as 2 weeks after your return is accepted by the IRS!

6. Paying a tax liability:

Sometimes, your employer has not withheld enough taxes during the course of your employment and you OWE taxes. In this case, you have the following options:

- Pay right away when you file with the money being directly debited from an account with a U.S. account and routing number.

- File without paying and set up a payment plan with the IRS to settle your account later. This can be paid with a debit or credit card and often you may be able to pay in lower installment amounts until the entire debt is paid.

*Note – If you opt to pay later, you will probably still need to pay your tax filing service and you may be subject to interest and penalties from the IRS.

7. Keep all your paperwork.

- It is important to keep as much of your paperwork as possible in order to ensure you are filing correctly.

- You should download and save all of your electronic paycheck records if possible before your employment contract ends because some employers immediately shut off your access to these records once your contract is complete.

*NOTE – If you have not received your W-2 in a timely manner and you can not get ahold of your employer, you can use the information from your last paycheck stub to file your taxes!